The Great AI Consolidation

Are we entering the AI consolidation phase? Thoughts on where the AI market is heading with the acquisitions of well-funded AI companies like Character AI and Inflection

I’m excited to share a new Deep Dive after a short hiatus.

Deep Dives are short posts offering a perspective on AI-related topics. Some of my previous ones covered autonomous agents, document extraction with LLMs, and a review of 2023’s state-of-the-art AI.

A NotebookLM-powered podcast episode discussing this post:

The AI industry is entering a consolidation phase as major tech giants like Microsoft and Amazon acquire or hire talent from smaller AI startups, securing exclusive rights to cutting-edge technologies. Meanwhile, key players like Stability AI and Aleph Alpha, up until recently Germany’s sole language model provider, are pivoting away from ambitious projects, citing commercialization challenges, and the future of remaining model providers like Mistral and Cohere remains a work in progress as they strive to differentiate themselves and establish their positioning in the fast-paced generative AI landscape.

But is this merely a phase in the AI industry's evolution, or are we witnessing the start of an AI oligopoly? A brief observation of the recent acquisitions and pivots of leading AI labs, including Adept, Inflection, Character AI, and Aleph Alpha, and a humble forecast for the companies still in the race.

The rise of Big Tech acquisitions

AI startups have reached unprecedented valuations and garnered massive customer bases. Character AI, a company that develops advanced conversational AI models allowing users to interact with customizable AI characters like Elon Musk and a couples therapist, had over 5 million monthly active users a year ago and was ranked as the 3rd top generative AI web app by a16z. Founded by Noam Shazeer and Daniel De Freitas, two highly respected AI researchers from Google, the company recently reached a valuation of $1 billion.

Last August, Google acquired its founders and most of its research team for $2.7B.

Adept, a company building AI-powered agents to automate digital tasks, was well-positioned to capitalize on the recent autonomous agents trend. Its novel ACT-1 model, which debuted in September 2022, was celebrated in the AI community long before the concept of AI agents became popular. Adept raised $415 million and was valued at ~$1 billion.

Last June, Amazon acquired its founders to join its growing AI division, reporting to Rohit Prasad, the former Alexa head who’s leading a new AGI team focused on building LLMs.

Using Adept’s Action Transformer model to turn natural language into actions

Microsoft has also joined the wave of AI consolidation, paying a staggering $650 million to AI startup Inflection for a non-exclusive licensing deal and, crucially, to hire the bulk of its top talent, including its co-founders.

![Snapinsta.app_video_AQPRsvuxdtB47BsL3oKpxHMclFIcmmE8IV7bgwHEywp80_g1aMCJP6uGciEdXIRRRDuyRONOpr7xq1ShIYIJGDA4.mp4 [optimize output image] Snapinsta.app_video_AQPRsvuxdtB47BsL3oKpxHMclFIcmmE8IV7bgwHEywp80_g1aMCJP6uGciEdXIRRRDuyRONOpr7xq1ShIYIJGDA4.mp4 [optimize output image]](https://substackcdn.com/image/fetch/$s_!w7r-!,w_1456,c_limit,f_auto,q_auto:good,fl_lossy/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F6351b4d4-0d2c-4986-b29d-32f8c4081744_720x900.gif)

What makes these acquisitions striking is that they often don’t involve outright purchases of entire companies. Instead, Big Tech firms opt for reverse “acquihires,” focusing on poaching talent and securing non-exclusive licensing deals, thereby sidestepping antitrust scrutiny. This tactic allows tech giants to assimilate the best minds and technology without raising the ire of regulators.

This all makes sense in an era when AI researchers are hard to come by, and Google’s co-founder calls researchers to prevent them from leaving for competing AI labs.

Big AI dreams, bigger bills

Building world-class AI models is becoming prohibitively expensive for startups. Developing competitive AI products, especially large language models, requires enormous computational resources and access to vast datasets. For instance, Adept AI’s ambitious plans to create models that translate natural language into machine actions would have required not only technical innovation but also continuous fundraising.

For a startup, surviving in a space where you must lease computational power from the same giants you’re trying to compete with is unsustainable. Startups often rely on cloud services from AWS, Azure, or Google Cloud, directly paying their rivals for the means to develop their own products. Add to this the exorbitant cost of AI research talent, which can command salaries into the millions, and it is easy to see why many startups struggle to stay independent.

With these acquisitions, not only are startups losing their autonomy, but Big Tech’s growing control raises concerns about a potential oligopoly in AI.

Become a premium member to get full access to my content and $1k in free credits for leading AI tools and APIs, including Claude, Hugging Face, Deepgram. It’s common to expense the paid membership from your company’s learning and development education stipend.AI oligopoly

The ongoing trend of Big Tech’s dominance in AI raises a critical question: Will all major AI research and applications ultimately end up in the hands of a few giants? If so, what does that mean for competition and innovation?

OpenAI, once an independent startup, is now heavily funded by Microsoft. Anthropic relies on investment from Google and Amazon.

One might argue that AI consolidation is a natural phase, much like in other industries where larger companies eventually absorb smaller players. However, AI is different. The technology is poised to influence everything from personal assistants to healthcare diagnostics, and control over its development could have significant societal implications. As we can see from Microsoft's acquisition of Inflection AI’s talent and technology, these moves are not just about enhancing corporate capabilities but also about positioning Big Tech as the gatekeeper of the future of AI.

With companies like Microsoft, Amazon, and Alphabet investing heavily in their AI ecosystems, startups increasingly face a difficult choice: either scale up dramatically to remain competitive or sell out to a tech giant.

Europe exiting the LLM arena, or not?

The pressure to transition from research to commercial success has not spared Europe's AI sector.

Aleph Alpha, founded in 2019 by Jonas Andrulis, was once hailed as Germany's most promising AI startup. The company aimed to develop powerful language models that could compete with those created by American tech giants while adhering to European values and data protection standards.

Raising a $500 million Series B less than a year ago, the company's efforts were crucial for maintaining European technological sovereignty in AI, especially given the dominance of U.S. and Chinese firms in the sector.

However, Aleph Alpha recently announced a pivot away from developing LLMs. Instead, the company will focus on creating AI systems for specific enterprise applications. This shift marks a significant change in strategy and raises questions about Europe's ability to compete in the global AI race.

With another well-funded AI company out of the game, Europe's AI ambitions now lie with the 18-month-old Paris-based Mistral. Founded by former Google and Meta AI researchers, Mistral has been making waves with its open-source approach and impressive technical achievements.

Explore previous deep dives:

Further consolidation

What lies ahead for the teams still building foundational models?

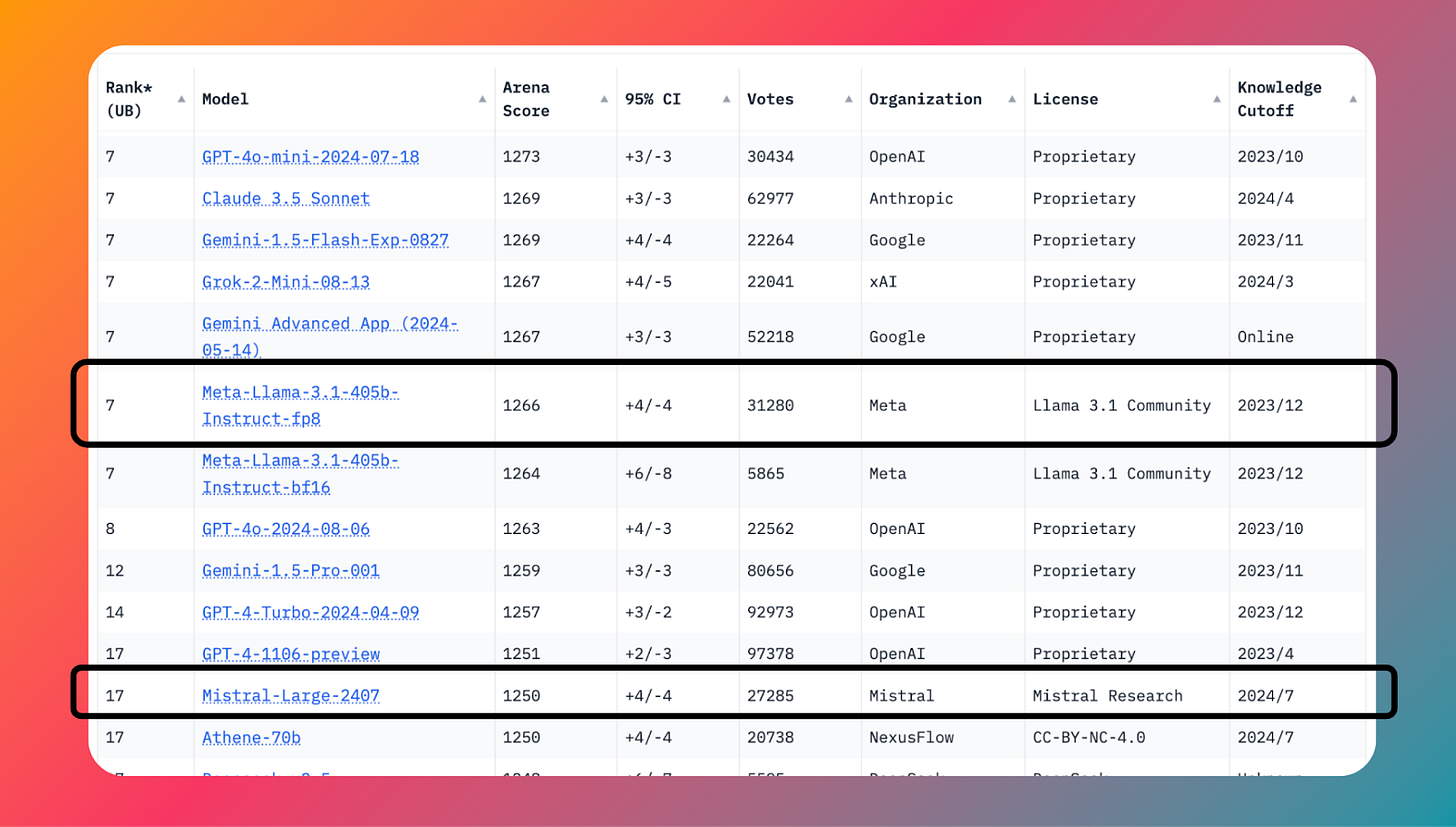

Mistral, known for its cutting-edge generative models like Mistral 7B and the multimodal Pixtral 12B, now faces increasing pressure from both sides of the AI model development market. On the open-source front, Meta continues to release powerful models such as Llama 3.1 405B and 3.2 90B, which have outperformed Mistral’s proprietary Large 2 on benchmarks and the Chatbot Arena leaderboard. Commercially, Mistral’s hosted Large 2 model also lags behind competitors like Claude 3.5 Sonnet and GPT-4o, raising questions about the company’s ability to maintain its competitive edge in both open-source innovation and proprietary offerings.

The Toronto/SF-based AI company Cohere is another long-time player in this space. It recently raised $500 million at a $5.5 billion valuation, although reportedly only having $35M in annual recurring revenue.

Mistral and Cohere represent two distinct strategies in the AI market, both attempting to carve out a niche in the face of Big Tech dominance. Mistral, for instance, has embraced an open-source approach, releasing models like Mistral 7B to foster community adoption and differentiate itself from the proprietary systems of larger players like Microsoft and OpenAI. This strategy not only aligns with the growing demand for transparency and on-premise deployment but also positions Mistral as an alternative for developers seeking more accessible and customizable tools.

Despite limited commercial traction, both Mistral and Cohere have raised significant capital (Mistral raised $645 million at a $6 billion valuation)—largely due to investor confidence in their cutting-edge technology and the potential for future breakthroughs. Investors are betting that, even with modest current revenues, these companies can scale by offering specialized models for enterprise applications or monetizing their technological advancements in the long term.

This ability to secure funding in the absence of high recurring revenue highlights the immense value placed on innovation and technical leadership in the AI sector, where future returns can outweigh immediate profitability. Nonetheless, both companies will likely face a similar outcome as their previous AI peers unless they generate the cash flow to sustain further model development and keep investors happy.

The tale of a founding team of researchers

This current AI wave brought a new trait to the most funded and lucrative AI startups—a trait Adept, Cohere, Aleph Alpha, Mistral, and Character all share—the founders come from a deep research background.

All these companies launched groundbreaking models within months of incubation, but they all faced a common challenge: commercialization and leadership. Adept lost two co-founders early on, while Character AI raised $150M without generating any revenue.

The lack of go-to-market experience may be a significant factor in these companies' openness to acquisitions. Generating recurring revenue is a new and difficult challenge for researchers who are used to focusing more on innovation and technical breakthroughs than on commercial strategy.

Conclusion: A Consolidated AI Future?

While the recent flurry of acquisitions suggests that we are indeed entering the consolidation phase of AI investments, it’s not necessarily the end of innovation in the space. Startups still play a crucial role in advancing AI research, but as development costs rise, they may increasingly rely on Big Tech for survival.

However, the real question isn’t whether Big Tech will dominate AI—it already does—but whether that dominance will stifle innovation and investment.

What’s clear, however, is that the age of wild, independent AI startups might be coming to an end.

If you find AI Tidbits valuable, share it with a friend and consider showing your support.

Very interesting analysis of the race. It seems to me that consolidation is one way to think about it. The question this account raises for me is what happens when the assumption that the current AI models are a path to something much more impactful (call it AGI if you want) turns out to be wrong. Then it seems to me there is a lot of potential for Mistral and a few other companies making small bets to win big.

It also highlights how much companies are willing to pay for top talent. The inflection and character.ai investments were all about the people and not the tech.